Protecting those who depend on you financially

In the insurance world, February is “Insure your love” month, a campaign organized to help others remember that life insurance is love insurance, and to reduce the stigma that portrays death as the focus of life insurance. No one likes to talk about their mortality, inevitable as it is. This month we suggest shifting the conversation to how to take care of those you love when/if the unthinkable happens.

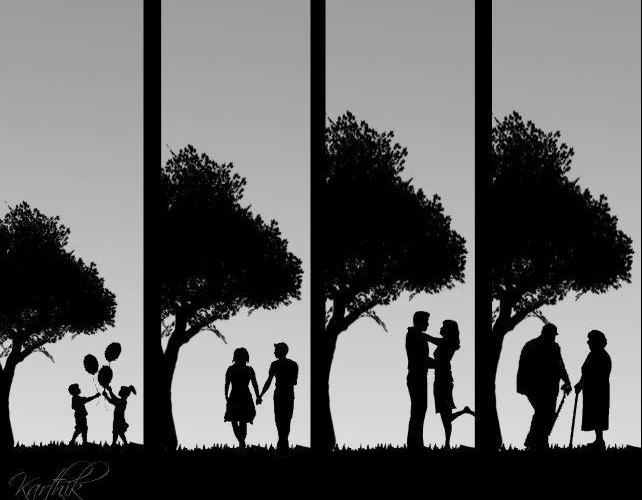

Which prompts a key question: How do you know if you need a life insurance policy? The answer is pretty straightforward: “If someone depends on you financially, you probably need life insurance.” Over the course of your life, who those dependents are and the appropriate degree of required financial protection varies. Some examples of specific life phases which might initiate the need for life insurance are:

Young and single. Acquiring debt (car loans, private student loans, etc.) is typical for a young person starting out, but along with the funeral expenses and settling of these debts, you wouldn’t want to leave burden for your family—life insurance can easily prevent that, and it’s remarkably affordable at this age.

Married or getting married. Most married couples depend on two incomes to cover their expenses. Ask yourself, if you were to become ill and die, or die suddenly, who would cover your part of the expenses? Would your spouse have to move, be in debt for medical bills, or pay your funeral costs? If the answer is “yes,” you need life insurance.

Family growth. If you are a parent you know the enormous responsibility that comes with that little bundle of joy! Food, shelter and education costs are only the beginning. From diapers and daycare to college tuition and all the great opportunities you want to provide for your child, raising kids is an expensive endeavor, one that you wouldn’t want to leave unfunded to your grieving family.

Divorce or single parenting. In addition to being the primary breadwinner, single parents are often also the provider for transportation, event scheduling, and everything else a child needs. Single parents need life insurance! And they need it affordable enough to fit in a one-income budget.

Planning for or in Retirement. When your debt is decreasing, and your children are on their own, you might believe that you no longer need life insurance, but that isn’t necessarily true. If you die, could your spouse pay for their usual, customary lifestyle expenses for 10, 20 or 30 more years? Or would they have to sell or abandon the things—home, belongings, personal treasures—you both spent a lifetime working to acquire? If you aren’t sure of the answer, life insurance can give you assurance.

You can see in these examples that what life insurance really does is insure that your loved ones can maintain the same life you provided for them. It’s uncomfortable to acknowledge you won’t live forever, but having a plan in place to protect the future of people you love is a peaceful feeling you won’t regret! Life throws you curveballs, y’all! Spend ten minutes talking with an insurance professional about your options. We can help you decide how much insurance you need, for how long, and what you can afford to pay.