Preventing Medical Bankruptcy

How to keep the C-word from causing the B-word

Few words wreak more emotional havoc than “cancer.” Cancer is a cold-blooded killer, fearsome in its randomness and terrorizing in its equal opportunity application. It not only assaults and destroys the body, but also attacks the family.

When someone is fighting cancer, everything “normal” about their family is changed. Normalcy is displaced by doctor visits, medicine regimens, dietary changes, sleep disturbances, and sadly (even with health insurance) mounting and unexpected bills.

So what does this mean for all of us? Despite our best efforts with eating right, exercising, staying out of the sun and cutting out tobacco, current statistics are still daunting: 1 in 2 men and 1 in 3 women will develop cancer in their lifetime.

It’s surprising to many that two-thirds (67%) of costs related to cancer treatment are for indirect or non-medical cost—things like a family member’s time lost from work to transport to doctor visits, or time spent in hospital with their loved one, etc.

Surviving cancer is common. Two out of three survivors were diagnosed five or more years ago, and one in six received their diagnosis 20 years ago or more. Projections are that by 2026 there will be 20.3 million cancer survivors in the U.S. With the hope of cure and people living longer with a cancer diagnosis, it’s more important than ever to prepare for the financial burden cancer produces.

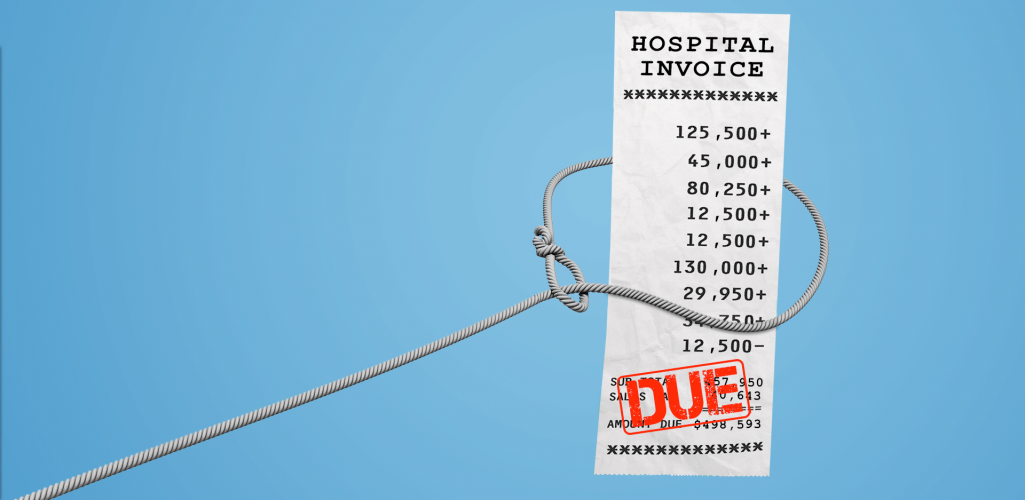

Medical bankruptcy affects a family every 30 seconds; that’s more than 1 million families annually forced to file bankruptcy because of unpaid medical bills. Why is this number so high? Because many people simply are not prepared for unexpected deductible and coinsurance costs. In addition, many misunderstand the alignment of a particular hospital or service as being “in-network” with their insurance plan. One in four people found that insurance denied part of their claims; others reached their insurance cap and coverage ran out.

The best way to avoid medical bankruptcy is to prepare for the crushing financial pressure cancer can cause. One affordable option in protecting your future earnings is a cancer policy. The best cancer policies will pay an initial diagnosis benefit, which is a lump-sum amount, in addition to benefits (all paid

directly to the insured) for treatment such as:

- chemotherapy, radiation, and immunotherapy

- hospital confinement

- surgery

- transportation and lodging, etc.

It’s impossible to overemphasize the importance of having a cancer policy for a family. In our work, we get to see firsthand how having the right cancer policy can take a family away from financial and emotional devastation, and instead focus their energies on healing rather than worrying over how to pay the bills. So if you’re looking for a fresh and truly valuable New Year’s Resolution, make it a point in 2019 to inquire about the ease, affordability and major benefits offered by a cancer policy.